Now let's look at filing a sales and use tax return, paying the tax due, and amending a return. Your account list is customized based on your account access. To file a return, choose the sales and use tax account and click 'File Return.' If you don't see the period you want to file, click 'More...' and select the correct period. If you don't have sales or purchases for the period, check the box for reporting zero on every line and click 'Submit'. To report sales and purchases, follow this three-step process. All three steps are required, even if you're not reporting sales in steps 2 and 3. In step 1, enter your total sales, any subtractions, and total purchases. The gray fields automatically calculate. Report county sales in step 2. If you don't have sales or purchases to report to a county with a tax, check the No County Tax box and click 'ok'. The counties you reported tax to on previous returns are already listed. To add a county, click in the open field under the County column and choose it from the drop-down. If you need to delete a county, click the red X to the left of the county row. It is not necessary to delete the counties which have no county tax to report for the period. Enter your total sales subject to county sales tax and total purchases subject to county use tax for each county. Your total sales and purchases calculate automatically as you enter amounts. Report stadium district sales and use tax on Step 3. The total sales and purchases you entered in Step 2 are automatically entered in Step 3 for counties with both a county tax and a stadium district tax. If you don't have sales or purchases to report to a stadium district, check the No Stadium Tax box...

Award-winning PDF software

How to prepare WV DoR ET 6.01 & ET 6.02 2024 Form

About WV DoR ET 6.01 & ET 6.02 2024 Form

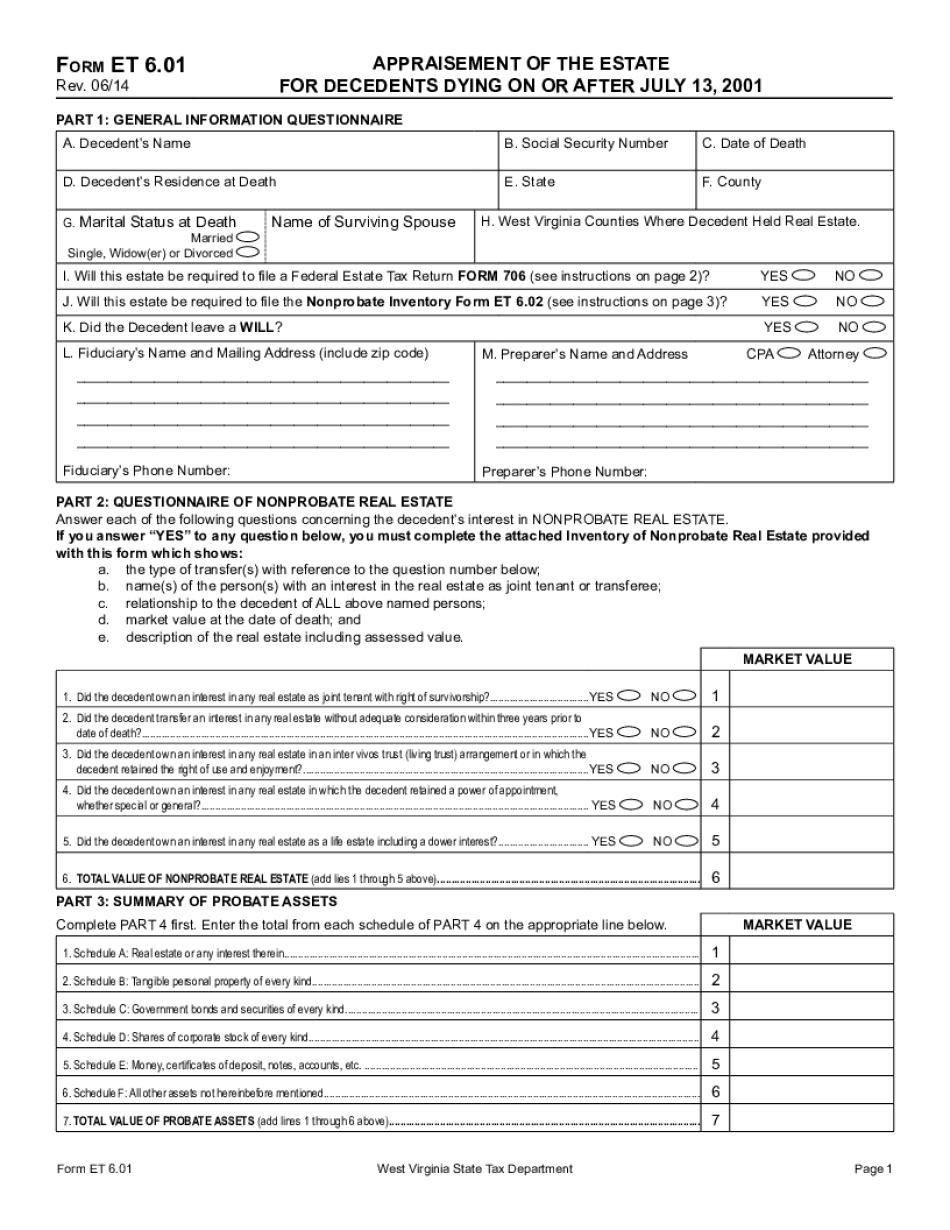

The WV DoR ET 6.01 & ET 6.02 2024 Form refers to the West Virginia Department of Revenue (WV DoR) Employer's Quarterly Unemployment Compensation Return and Contribution Report. This form is used by employers in the state of West Virginia to report their quarterly wages and calculate the unemployment compensation contributions they need to make. The WV DoR ET 6.01 & ET 6.02 2024 Form is required to be filed by all employers liable for unemployment compensation contributions in West Virginia. This includes businesses or individuals who have employed one or more persons for any part of a day in each of 20 different weeks in the current or preceding calendar year. The form must be filed for each calendar quarter, and the due dates for submission are typically in April, July, October, and January. Employers are required to report the total wages paid to their employees during the quarter, and based on these wages, they calculate the amount of unemployment compensation contributions they owe to the state unemployment fund. The form also requires the employer to provide additional details such as their employer account number, business information, and contact details. Employers must ensure accurate and timely completion of the WV DoR ET 6.01 & ET 6.02 2024 Form to fulfill their tax obligations and contribute to the state's unemployment compensation program. Filing this form helps the West Virginia Department of Revenue track and administer unemployment benefits appropriately.

Online options enable you to coordinate your own document administration and also increase the output of one's workflow. Follow the rapid guidebook to do WV DoR ET 6.01 & ET 6.02 2024 Fillable Wv, stay away from mistakes and prthat on time:

How to finish any WV DoR ET 6.01 & ET 6.02 2024 Fillable Wv online:

- On your website with the form, just click Start Now and cross to the publisher.

- Use the actual hints in order to complete the kind of fields.

- Include your individual data and contact files.

- Make certain that one enters correct data along with quantities inside correct fields.

- Very carefully confirm the content of the PDF and also syntax as well as punctuational.

- Go to Help segment when you have inquiries or perhaps tackle our Support crew.

- Put an electronic personal on the WV DoR ET 6.01 & ET 6.02 2024 Fillable Wv by using Indicator Instrument.

- When the form is finished, press Accomplished.

- Distribute the actual all set PDF by way of e-mail as well as facsimile, printing it out or even reduce your current system.

PDF writer permits you to help to make modifications on your WV DoR ET 6.01 & ET 6.02 2024 Fillable Wv through the world wide web related system, personalize it according to the needs you have, signal this digitally and distribute diversely.

What people say about us

Submitting documents online saves your time

Video instructions and help with filling out and completing WV DoR ET 6.01 & ET 6.02 2024 Form